The Definitive Guide to Lamina Loans

Wiki Article

Not known Factual Statements About Lamina Loans

Table of ContentsThe Definitive Guide to Lamina LoansThe Greatest Guide To Lamina LoansThe Best Guide To Lamina LoansThe Ultimate Guide To Lamina LoansThe Greatest Guide To Lamina LoansThe Greatest Guide To Lamina Loans

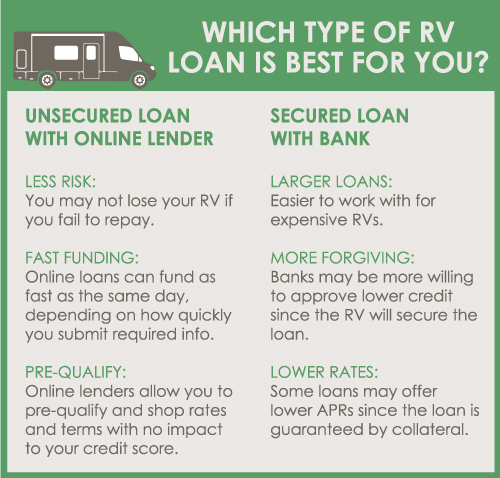

Lenders depend entirely on your credit reliability, income level as well as quantity of current financial obligations when deciding whether you're a great prospect. Because the risk is higher for the lending institution, APRs are also normally greater on unsecured fundings (Lamina Loans).

In particular instances, the name or the purpose of the loan issues. The purpose of your funding can establish your rates as well as also credit reliability in the eyes of lenders. For example, some lending institutions will certainly offer different personal finance terms based upon the finance's desired purpose or provide personal finances for details functions.

Little Known Questions About Lamina Loans.

If you are approved, the lender additionally designates a rates of interest to your financing. The yearly percentage price (APR) establishes the amount of passion you'll pay on your lending. Like passion prices, APRs are expressed as a percent. APRs likewise take costs into account to give you a far better sense of your lending's complete price.Calculate your estimated loan expenses by utilizing this personal finance calculator. Input estimates of the financing quantity, rates of interest and loan term to obtain a suggestion of your prospective settlement and overall expenses for getting an individual lending. Your three-digit credit scores rating plays a large role in your capability to obtain money as well as rack up a desirable rate of interest.

, contrast your financing terms as well as each lender's costs generally, both rate of interest rate as well as costs will certainly be reflected in the APR. As soon as you've discovered a lender you would certainly like to function with, it's time to relocate onward.

The Buzz on Lamina Loans

Obtaining a lending isn't as tough as it used to be, yet you can't simply use for a funding anywhere. Your debt score issues, and a business that aligns with your circumstance is best.

Here's everything you need to find out about searching for and also obtaining loans online. You can obtain numerous loan types online, yet the most common (as well as often most versatile) alternative is the online individual finance. Most personal financings are unsecured, indicating you do not require read this post here security, and you can use them for nearly any kind of objective.

All About Lamina Loans

: Fair, poor Yes: As quick as 1 company day: 0% 8%: $15 or 5% of payment: 36 or 60 months For added options, have a look at our picks for the ideal individual financing lending institutions. Quick, practical finance applications Same-day financing commonly offered Flexible and can be made use of for financial obligation consolidation, organization expenses, house renovations, and also more Reduced rates than on the internet payday advance loan Unsafe, so no collateral goes to danger Easy to contrast choices and also rates Bad-credit alternatives offered Prices may be more than a protected lending, such as a house equity lending Prices may be greater than with your individual bank or lending institution Require due persistance (cash advance and predative lending institutions may impersonate personal finance lenders) The finances we have actually discussed are on-line personal finances, but you must be wary of payday financings.

On-line financings make contrast shopping straightforward and convenient. An APR of 5% on a $30,000 funding would indicate you 'd pay regarding $1,500 in rate of interest every year to borrow the money.

Every lender costs different fees, such as source fees, late repayment fees, application charges, and extra. Other costs are not included in the APR, such as late settlement costs or prepayment penalties.

An Unbiased View of Lamina Loans

Be certain to get a complete breakdown of any kind of fees you'll pay with each lending institution, so you can consider them in your decision. Compare the total regards to each finance option. Longer settlement terms imply reduced monthly payments, however they additionally suggest paying much more in rate of interest in the future.On-line finances can here provide you with the cash you need to cover costs swiftly and also conveniently. Before you move ahead with an on-line loan, however, make sure that the lending is risk-free and also the lender is legitimate. Here are some of the pros as well as cons of online loans. Safe on-line car loans offer a range of advantages consisting of: You can get an online financing at any type of time from the convenience of your own house.

When you are investigating numerous online fundings, you'll discover it easy to contrast the offers you get. You'll be able to identify which loan is the best option for your private spending plan, requires, and also preferences.

The Main Principles Of Lamina Loans

On-line loan lenders typically use pre-approvals. Even if you have negative or fair credit rating, you might still get authorized for quick safe lendings online.Report this wiki page